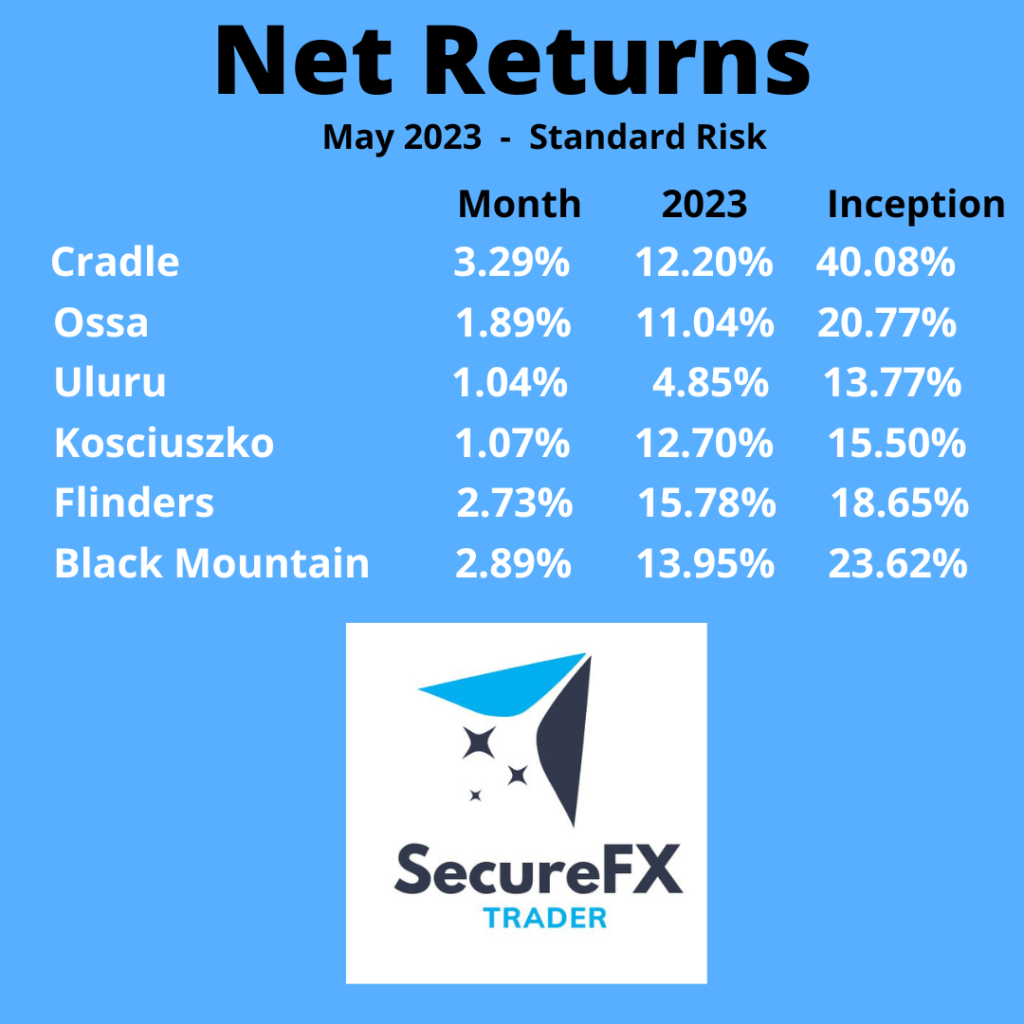

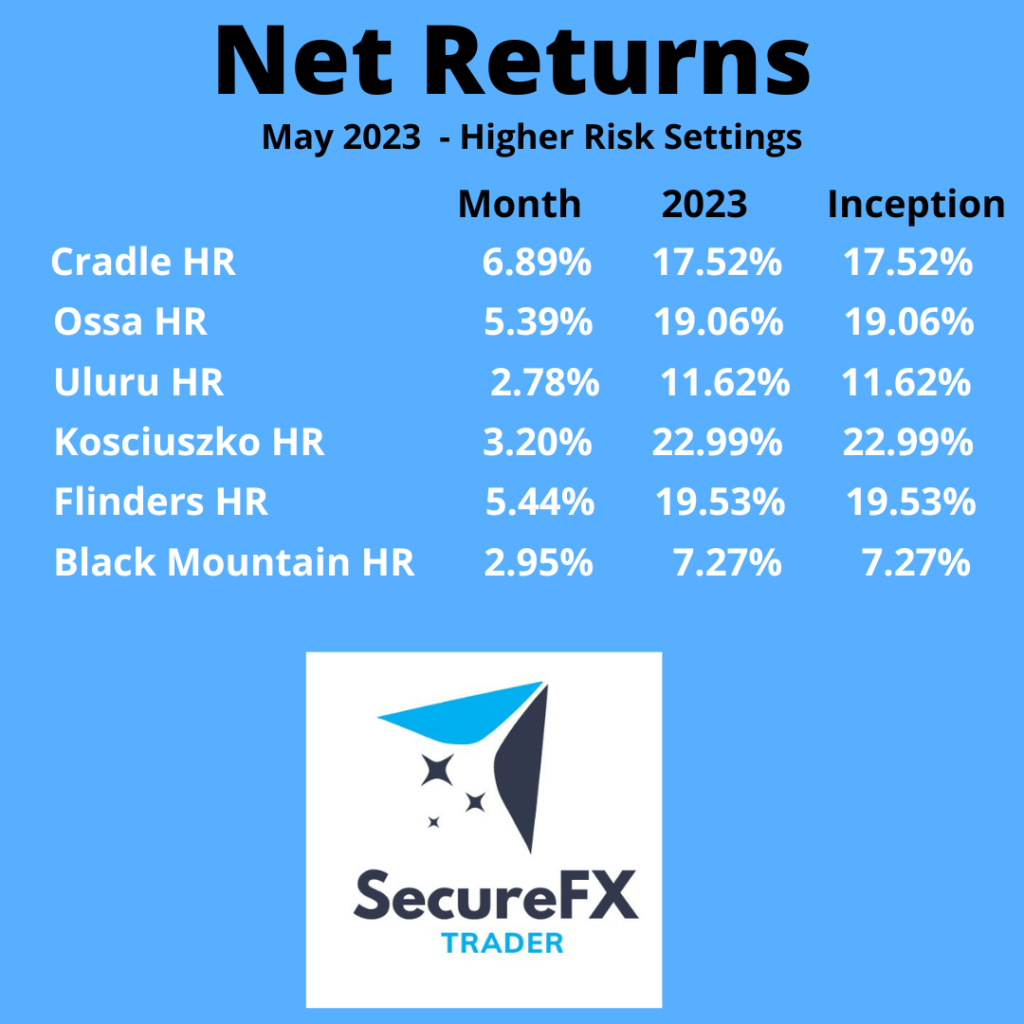

Please find attached the net returns for May 2023 for standard risk and higher risk strategies.

Not far now from the half year and based on the current results each of the strategies should achieve a return of between 20% to 30% for the year for the standard risk. The exception is Uluru which we have previously discussed.

The returns on Kosciuszko are down as we had two stop losses occur on some trades. These are in place to ensure the draw down does not get out of control and protects the capital. There are a few trades still open that we are waiting for the market to turn and close out in June.

The higher risk setting strategies are trading strong and keeping draw downs in check. Producing nice returns with limited risk.

If you have any queries, please do not hesitate to reach out.